With economic downturns and employees being laid off everywhere, individuals face termination of their professional relationships. Although emotional and logistical challenges accompany this termination, it also introduces another layer of complexity – severance pay taxation.

Table of Contents

Companies offer employees severance pay as compensation for terminating their employment to help them during the times of transition. The severance packages include salary continuation, benefits continuation, and additional perks. The structure of the packages can significantly impact the tax liabilities of the recipients, which is why you need to understand the taxation of severance pay.

If you just joined the company and have no prior working experience, you surely know little about severance packages. Are severance packages taxed? Let’s find out. We will discuss the complexity of severance pay taxation to help you navigate this financial terrain by having the correct information.

Taxation of Severance Pay

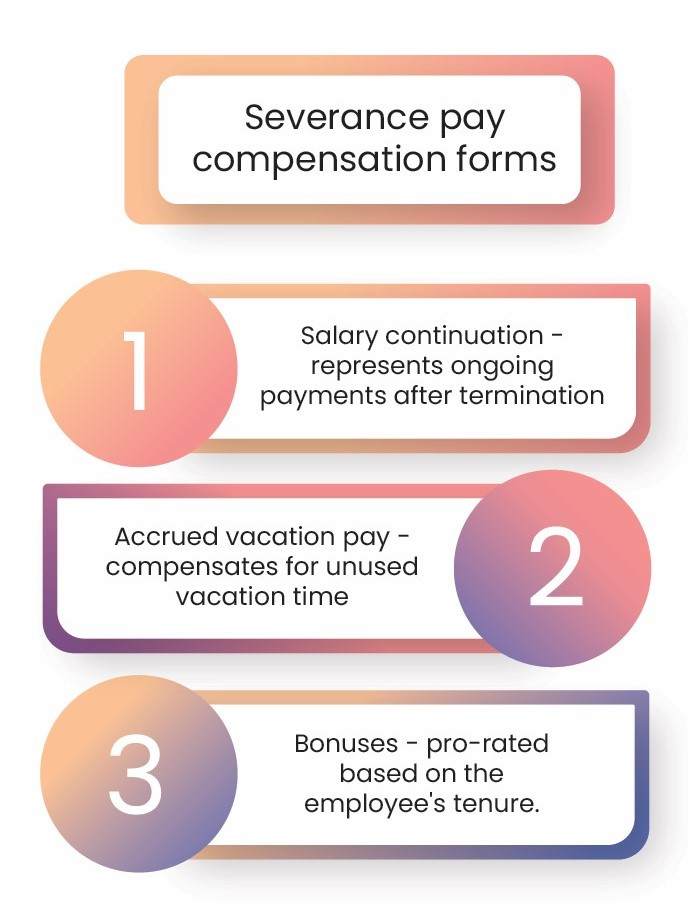

To answer the question “Do you get taxed on severance pay,” you must fully understand what severance tax is. Severance packages typically consist of various forms of compensation:

Each of these compensation types is subject to distinct tax treatments. You are most likely unaware of paying taxes because they are usually removed from your paycheck as tax withholdings. How the employer categorizes your severance pay (as regular or supplemental wages) will determine the tax rate.

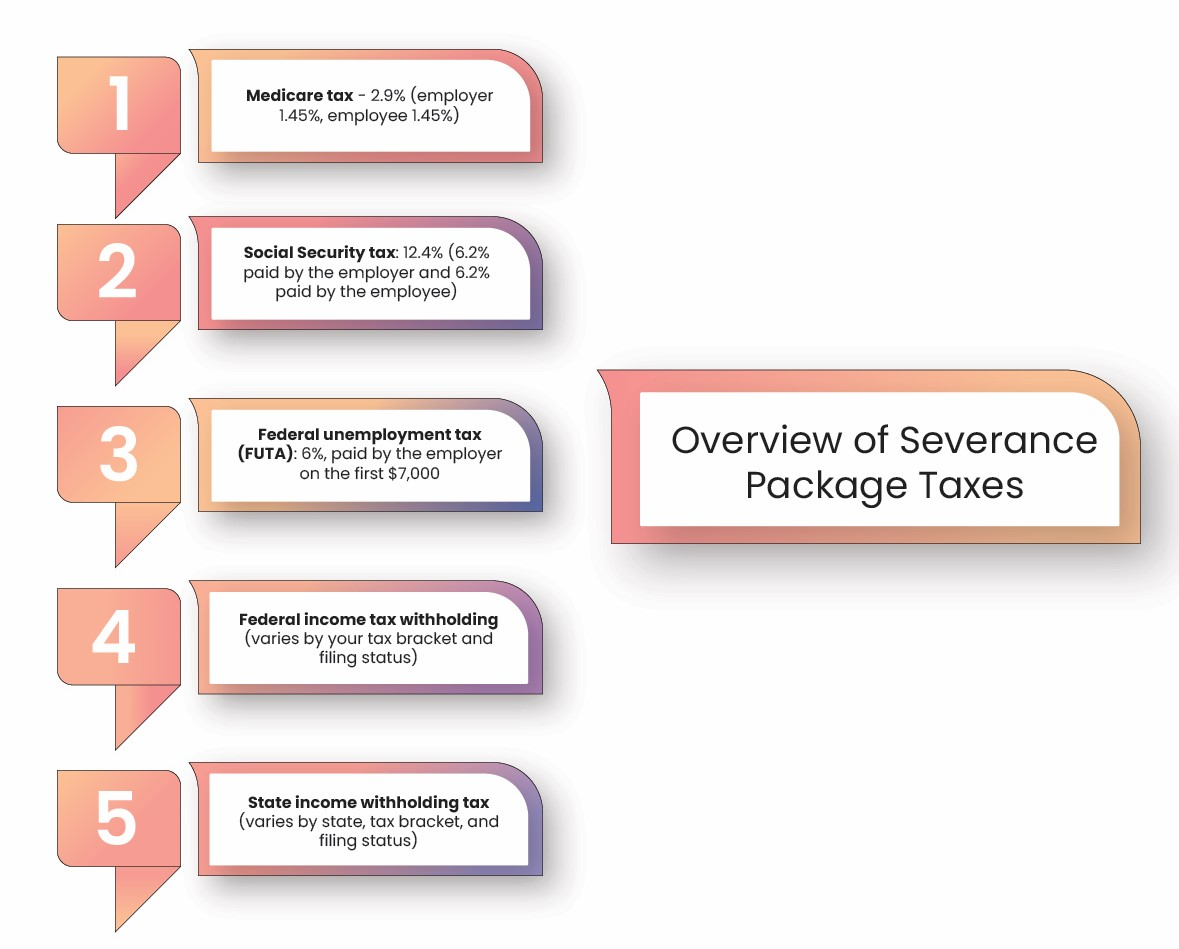

So, how much taxes are taken out of a severance package? According to the IRS, severance pays are considered supplemental wages, and you should expect deductions of the following:

- State Income Tax

- Federal Income Tax

- Federal Unemployment Tax

- Medicare Tax

- Social Security Taxes

Lump Sum vs. Periodic Payments

An important decision during severance negotiations is the structure of payments – lump sum or periodic. The choice between these options significantly impacts the tax liabilities for both employers and employees.

- Lump-sum payments are taxed in the year of receipt, potentially pushing individuals into a higher tax bracket. It means the IRS may consider a lump-sum severance pay as a raise because the paycheck gets bigger. This, in turn, means that the withholding will increase.

- Periodic payments spread the tax burden over multiple tax years, providing a more measured impact on taxable income. The IRS will consider it your regular paycheck, and the withholding will generally remain the same as on your previous paychecks.

When you negotiate the form of your severance pay, consider these factors. When applying for a new job, we often worry a lot about getting noticed by hiring managers, and severance packages are the least of our concerns. This is because candidates are worried about getting the job, so questions of this sort don’t cross their minds. Next time you apply for a job, you might also want to think about severance packages.

Federal Income Tax Withholding

The federal income tax withholding generally varies depending on the tax bracket and filing status:

| Tax Bracket | Filing status |

| 10% 12% 22% 24% 32% 35% 37% | Single filer Married filing jointly Married filing separately Head of household |

Employers offering severance pay must pay the employee everything per their agreed terms. This is especially true when layoffs are due to downsizing or other organizational changes.

Employees wishing to downsize their tax liability can do this by:

- Increasing their retirement contributions

- Donating to charities

- Participating in employer-sponsored plans

- Profiting from losses

FICA and Medicare Taxes

FICA (Federal Insurance Contributions Act) imposes paying taxes on both employers and employees. Severance pay is also subject to FICA taxes and impacts the Social Security and Medicare contributions. The FICA contributions are mandatory, and the limit changes annually, depending on the National Average Wage Index.

The employer and employee equally split the Medicare tax, with a tax rate of 1.45% paid by each. The total Medicare tax charged is 2.9% and is used to fund costs for hospitals and nursing homes for the disabled and elderly.

State Income Tax Considerations

Most US states impose state income taxes and collect taxes from their residents using tax withholding systems. It is done by combining their own worksheets and IRS W-4 Forms. The state withholdings greatly depend on your tax filing status and tax bracket. The income tax withholding can also vary by state.

New Jersey and Hawaii are states where residents pay the highest income tax of more than 10%. Residents of nine US states are not obliged to pay income tax, including:

- Alaska

- Nevada

- Texas

- Florida

- New Hampshire

- Washington

- South Dakota

- Tennessee

- Wyoming

We recommend always being aware of state-specific regulations and considering their impact when negotiating your severance packages.

Tax Deductions for Employers

Employers are not always contractually obligated to offer severance packages, so the scope of what is offered can vary between companies. This also makes employers eligible for tax deductions related to severance pay. Understanding these potential deductions can influence the structure and amount of severance packages offered.

However, reporting the severance pay to tax authorities is mandatory for employers. Compliance is vital to avoid legal repercussions. If your company is undergoing workforce reduction, navigate the tax considerations carefully, balancing the financial responsibilities and legal obligations.

Impact on Unemployment Benefits

How severance pay can impact eligibility for unemployment benefits depends on several factors – where you live, the amount and length of your severance, and more. The Department of Labour prepares general guidelines, but each state has its own requirements.

Before agreeing to any severance package, it’s best to research and understand the state’s policy. Unemployment benefits are considered taxable income, so request tax withholding when you file for unemployment.

Other Considerations

Employers may offer severance packages as a gesture of goodwill, to stay competitive in the marketplace, to recognize the employee’s service, or to prevent lawsuits. If you have yet to negotiate the terms when you accepted the job, then make a note to review the employment contract for tax-related clauses. You can negotiate on:

- Insurance coverage – find out if your employer can pay your health coverage until you find a new job. There is also a possibility for financial assistance for unemployed workers.

- Pension Plans and Stock – the destiny of your stock, pension, or individual retirement account (IRA) depends on the employer or state. Always ask your employer for a copy of the policies to know what to expect.

Always consult with tax professionals for personalized advice before you make any move and accept any offer from an employer. This will reduce the headaches further down the line.

One way to know how the company stands is to ask the right questions during your job interview. You can’t ask directly about severance packages, but based on the answers you get about the company’s future plans and organizational structure, you can get an idea of its standing.

Reporting Severance Pay on Tax Return

Is a severance package taxable? Yes, severance pay and other types of compensation are taxable in the year in which they are paid. When distributing severance, vacation, or sick pay, your employer may automatically withhold your appropriate tax amounts. They usually do this in two ways:

- As part of your normal wages where the normal withholdings also apply to the severance pay.

- Separate from your wages when they generally apply a flat 22% withholding tax rate for federal income tax.

Accurate documentation and reporting of severance pay on a federal tax return are imperative. Compliance with tax laws ensures a smooth tax filing process and avoids penalties. Employees should retain relevant documentation, such as Form W-2, to facilitate accurate reporting.

Final Thoughts

Are severance packages taxed? The tax implications of severance packages require careful consideration. Understanding the complexity of federal and state tax regulations and comprehending the impact on unemployment benefits are essential elements in navigating this complex terrain.

Consult with tax professionals and review employment contracts for the needed guidance to make informed decisions during challenging times.

FAQs

How can I adjust federal income tax withholding on severance pay?

Employees can adjust federal income tax withholding by submitting a revised Form W-4 to their employer. This form allows individuals to specify the number of allowances and additional withholding amounts, helping them manage their tax liabilities effectively.

What is a generous severance package?

Severance packages can vary from very generous to very stingy. The generous option would be one month’s worth of salary for every year with the company. The frugal option is they offer you just one week’s worth of salary for each year.

Can I think about accepting the severance package?

Yes, the usual time is 21 days to accept the severance package offer after you have negotiated all the details. Once signed, you are given 7 days to change your mind, after which the agreement is final.